Aerostat Systems Market by Sub-System, by Product Type (Balloon, Airship, Hybrid), by Propulsion System (Powered, Unpowered), by Class (Compact-Sized, Mid-Sized, Large-Sized), by Payload, by Geography - Global Forecast to 2034

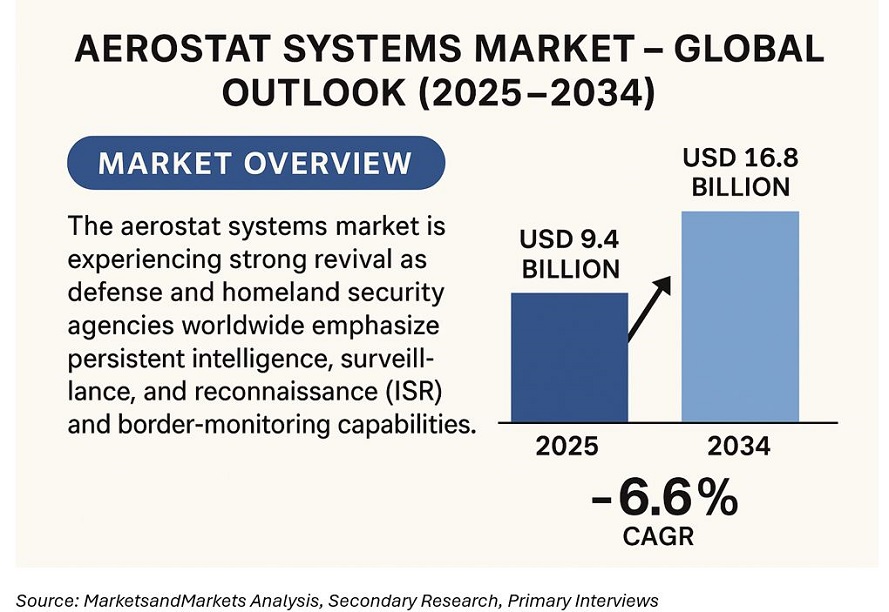

The aerostat systems market is experiencing strong revival as defense and homeland security agencies worldwide emphasize persistent intelligence, surveillance, and reconnaissance (ISR) and border-monitoring capabilities. In 2025, the market is estimated at around USD 9.4 billion and is projected to reach approximately USD 16.8 billion by 2034, registering a compound annual growth rate (CAGR) of about 6.6%.

Aerostat systems—comprising tethered balloons, blimps, and airships equipped with electro-optical, radar, or communications payloads—offer long-endurance, cost-effective monitoring platforms capable of operating for weeks at a fraction of the cost of aircraft or satellites. Once used primarily for military early-warning radar, they are now increasingly adopted for coastal surveillance, communication relay, border security, disaster management, and event protection.

The combination of defense modernization, low-cost persistent surveillance requirements, and advancements in lightweight materials and power systems has expanded the addressable market from traditional defense customers to civilian security and commercial telecom networks.

Market Dynamics

Key Growth Drivers

- Defense and Homeland Security Programs: Governments are deploying aerostat-based ISR platforms to secure land and maritime borders.

- Persistent Surveillance Advantage: Aerostats can stay aloft for weeks at 1,000–15,000 ft, offering constant coverage with high endurance and lower cost than UAVs or aircraft.

- Technological Evolution: Introduction of lighter composite envelopes, compact mooring systems, and miniaturized EO/IR and radar payloads enhance mission efficiency.

- Cost Efficiency: Aerostat systems provide 24×7 situational awareness at nearly one-tenth the operational cost of fixed-wing aircraft.

- Disaster Response and Communication Relay: Emerging civilian uses for emergency communication and disaster-recovery operations are broadening adoption.

Challenges

- Vulnerability to severe weather conditions and physical threats (winds, lightning, hostile fire).

- Limited mobility compared with UAVs and manned ISR assets.

- Infrastructure and skilled personnel required for maintenance and deployment.

Opportunities

- Hybrid aerostats integrating lighter-than-air lift with electric propulsion for repositionable missions.

- Civilian applications in broadcasting, telecommunications, and environmental monitoring.

- Indigenous manufacturing initiatives in Asia Pacific and the Middle East reducing procurement dependency.

Market Segmentation

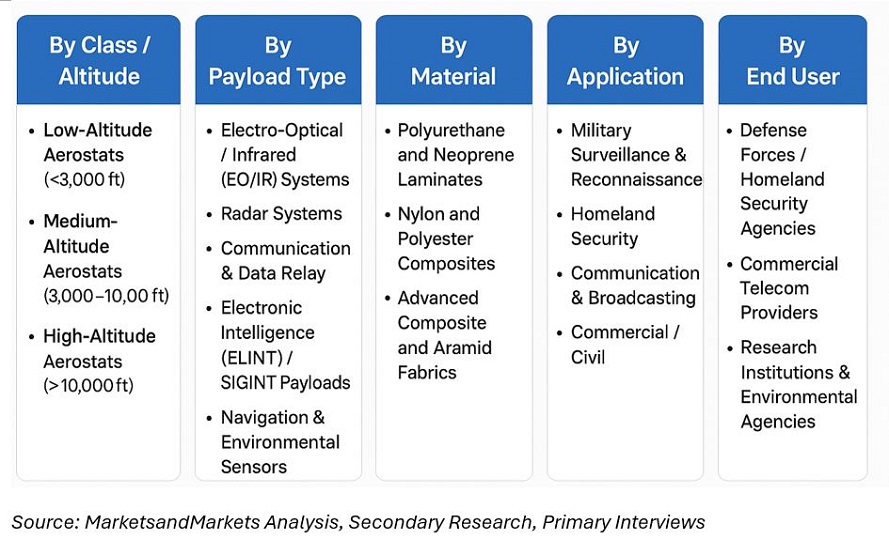

By Class / Altitude

-

Low-Altitude Aerostats (<3,000 ft):

Deployed for perimeter security, event surveillance, and tactical observation. -

Medium-Altitude Aerostats (3,000–10,000 ft):

Most widely used; provide multi-sensor surveillance and communications coverage. -

High-Altitude Aerostats (>10,000 ft):

Strategic ISR and radar coverage platforms capable of wide-area maritime and airspace monitoring.

By Payload Type

-

Electro-Optical / Infrared (EO/IR) Systems:

Cameras for day-night imaging, tracking, and targeting. -

Radar Systems:

Ground-moving target indicator (GMTI), air-surveillance, and synthetic aperture radar (SAR) payloads for all-weather detection. -

Communication & Data Relay:

Line-of-sight extension for tactical radio, satellite, and LTE/5G networks. -

Electronic Intelligence (ELINT) / SIGINT Payloads:

Used in defense for electronic warfare, signal interception, and emitter geolocation. -

Navigation & Environmental Sensors:

Used in meteorology, disaster management, and environmental research.

By Material

-

Polyurethane and Neoprene Laminates:

Common envelope materials offering UV and gas permeability resistance. -

Nylon and Polyester Composites:

Lightweight fabrics providing flexibility and durability. -

Advanced Composite and Aramid Fabrics:

High-strength, lightweight envelopes for large strategic aerostats.

By Application

-

Military Surveillance & Reconnaissance:

Persistent border, coastal, and tactical ISR missions. -

Homeland Security:

Anti-infiltration, smuggling, and disaster-response surveillance by police and paramilitary agencies. -

Communication & Broadcasting:

Temporary airborne towers for telecom and broadcast coverage in remote regions. -

Commercial / Civil:

Event monitoring, wildlife protection, and scientific research.

By End User

- Defense Forces / Homeland Security Agencies – Primary adopters for border and coastal surveillance.

- Law-Enforcement & Disaster-Management Agencies – Civil-use aerostat operators.

- Commercial Telecom Providers – Emerging buyers for airborne communication relay.

- Research Institutions & Environmental Agencies – Using smaller aerostats for weather and pollution studies.

By Aerostat Type

-

Tethered Aerostats:

Fixed to a ground mooring station via cable; provide stable platforms for ISR and communications at altitudes up to 5 km. Dominant segment globally. -

Free-Floating Aerostats (Airships):

Semi-autonomous or remotely controlled airships for extended mobility; used for area surveillance and telecom relay missions. -

Hybrid Aerostats:

Combine lighter-than-air gas lift with aerodynamic lift and optional propulsion for limited maneuvering—emerging trend for next-gen ISR.

Technology Landscape

Aerostat systems are evolving through improvements in envelope materials, payload miniaturization, and ground control automation. Key technology shifts include:

- Autonomous Control Systems: Automated launch, recovery, and tether tension management reduce crew requirements.

- Power and Endurance Upgrades: Integration of solar panels and hybrid battery-generator systems enable month-long endurance.

- High-bandwidth Data Links: Optical and Ka-band communication channels for real-time video and radar feed transmission.

- Sensor Fusion: Combining EO/IR, radar, and acoustic sensors for multi-domain awareness.

- AI-assisted Analytics: Onboard processing of imagery for rapid threat detection and tracking.

Regulatory & Standards Outlook

- FAA Part 101 (US) and EASA CS-31G regulate tethered lighter-than-air aircraft operations, airspace clearance, and line-of-sight restrictions.

- MIL-STD-810H and STANAG 4671 outline environmental testing and interoperability for military aerostats.

- Civil deployments require coordination with ICAO Annex 2 for controlled airspace integration.

These frameworks ensure safe operation, reliability, and certification of systems across defense and civilian sectors.

Sustainability Perspective

Aerostat systems are inherently low-carbon surveillance assets. Their buoyant lift drastically reduces fuel consumption compared with rotary or fixed-wing ISR aircraft. Recent trends show use of helium-recycling systems, solar-assisted power units, and recyclable envelope materials. Governments view them as an environmentally sustainable means of continuous monitoring, aligning with defense green-procurement directives.

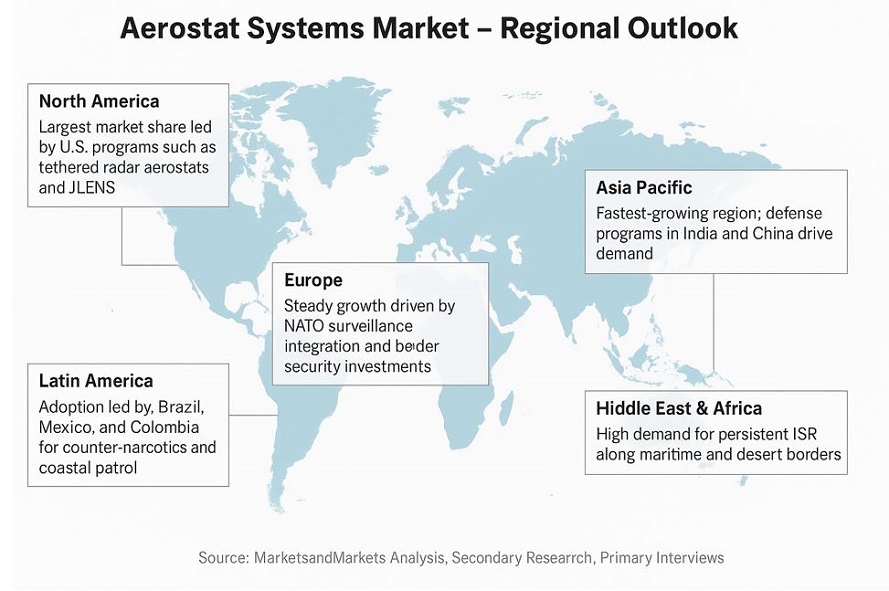

Regional Outlook

North America:

Largest market share, led by U.S. programs such as the JLENS (Joint Land Attack Cruise Missile Defense Elevated Netted Sensor System) and Customs & Border Protection tethered radar aerostats. Canada employs systems for Arctic surveillance.

Europe:

Steady growth driven by NATO surveillance integration and border security along southern and eastern perimeters. The U.K., France, and Germany invest in tactical aerostat upgrades and hybrid airships for intelligence missions.

Asia Pacific:

Fastest-growing region. India’s DRDO and BEL operate aerostat-based radar systems for border and coastal monitoring; China develops large-altitude hybrid airships for ISR and communication relay; Japan and South Korea fund maritime domain-awareness networks.

Middle East & Africa:

High demand for persistent ISR along maritime and desert borders. Israel, Saudi Arabia, and UAE lead deployments of radar and ELINT aerostats for threat detection. African nations use smaller tethered systems for border and wildlife protection.

Latin America:

Adoption led by Brazil, Mexico, and Colombia for counter-narcotics, coastal patrol, and event security. Government modernization programs are supporting local integration of EO/IR and radar payloads.

Competitive Landscape

Leading companies:

- TCOM L.P. (U.S.) – Dominant provider of tactical and strategic tethered aerostat systems.

- Raven Aerostar (Aerostar International, U.S.) – Specializes in high-altitude, solar-powered, and hybrid systems.

- Lockheed Martin Corporation (U.S.) – Develops large persistent surveillance aerostats and airships.

- RT Aerostat Systems (Israel) – Tactical and medium-altitude systems for defense and homeland security.

- ILC Dover LP (U.S.) – Envelope materials and mooring solutions.

- Aeros Corp. (U.S.) – Hybrid airship systems for cargo and ISR applications.

- Drone Aviation Holding Corp. (U.S.) – Compact tethered aerostat solutions for urban monitoring.

- ISRO / DRDO (India) – Indigenous aerostat and radar integration under “Make in India.”

Competition centers on endurance, payload capacity, mobility, and modularity. New entrants focus on compact tactical systems with rapid deployment and lower logistical footprint.

Market Outlook and Key Takeaways

|

Metric |

2025 |

2034 |

CAGR |

|

Market Size |

USD 9.4 B |

USD 16.8 B |

~6.6 % |

Highlights:

- Defense and homeland security remain dominant revenue contributors (>70%).

- Asia Pacific records the highest growth due to indigenous programs.

- Hybrid aerostats and telecom relay use cases represent next-decade opportunities.

- Continuous R&D in high-strength envelope materials and automated control will define future differentiation.

FAQs

1. What is the size of the aerostat systems market?

About USD 9.4 billion in 2025, projected to reach USD 16.8 billion by 2034.

2. Which type of aerostat is most widely used?

Tethered aerostats dominate global deployments due to reliability and cost efficiency.

3. What payloads are most common?

EO/IR sensors and radar payloads account for over 60% of installations worldwide.

4. Which region offers the fastest growth?

Asia Pacific, led by defense programs in India and China and rising border-security investments.

5. How are aerostats advancing technologically?

Through hybrid propulsion, AI-based analytics, composite envelopes, and solar-assisted endurance systems.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Study Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

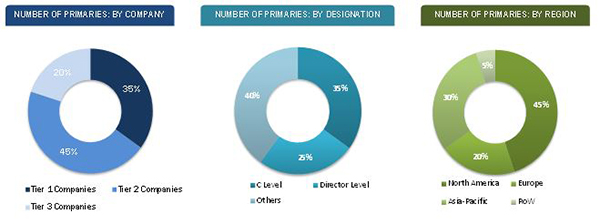

2.1.2.2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Growing Emphasis on Improving Surveillance to Counter Terrorism

2.2.3 Supply-Side Indicators

2.2.3.1 Decreasing Production of Helium

2.2.3.2 Advancements in EO/IR Technology and Integration

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in Aerostat Systems Market

4.2 Aerostat Systems Market, By Sub-System

4.3 Global Aerostat System Market, By Product Type

4.4 Global Aerostat System Market, By Propulsion System

4.5 Global Aerostat System Market , By Class

4.6 Global Aerostat System Market, By Payload

4.7 Global Aerostat System Market, By Region

4.8 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Sub-System

5.2.2 By Product Type

5.2.3 By Propulsion System

5.2.4 By Class

5.2.5 By Payload

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Ability of Aerostats to Provide Persistent Surveillance for A Longer Duration

5.3.1.2 Ability to Provide Vital Geospatial Evidence

5.3.1.3 Increasing Focus on Using Economical Solutions for Surveillance

5.3.2 Restraints

5.3.2.1 Payload Related Restrictions

5.3.2.2 Limitations Pertaining to Operational Altitude

5.3.3 Opportunities

5.3.3.1 Development of New Sensor Related Technologies

5.3.3.2 Use of Aerostats in Coordinating Missile Defense

5.3.4 Challenges

5.3.4.1 Vulnerability to Adverse Weather Conditions

5.3.4.2 Survivability Related Issues

5.3.4.3 Concerns Regarding Flight Safety and Privacy

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Technology Trends

6.2.1 Use of More Advanced Aerostat Material

6.2.2 Development of Smaller Aerostats and Helikites

6.2.3 Application of Aerostats in Power Generation

6.2.4 Development of Cargo Airships for Carrying A Heavier Payload

6.2.5 Extension of Communication Range of Aerostats

6.3 Porters’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 List of Recent Patents Granted

7 Aerostat Systems Market, By Sub-System (Page No. - 48)

7.1 Introduction

7.2 Aerostat

7.3 Ground Control Station(GCS)

7.4 Payload

8 Aerostat Systems Market, By Product Type (Page No. - 51)

8.1 Introduction

8.2 Balloon

8.3 Airship

8.4 Hybrid

9 Aerostat Systems Market, By Propulsion System (Page No. - 54)

9.1 Introduction

9.2 Powered Aerostats

9.3 Unpowered Aerostats

10 Aerostat Systems Market, By Class (Page No. - 57)

10.1 Introduction

10.2 Compact-Sized Aerostats

10.3 Mid-Sized Aerostats

10.4 Large-Sized Aerostats

11 Aerostat Systems Market, By Payload (Page No. - 60)

11.1 Introduction

11.2 Surveillance Radar

11.3 Inertial Navigation Systems

11.4 Camera

11.5 Communication Intelligence (Comint)

11.6 Electro-Optic/Infrared Sensor (EO/IR)

11.7 Electronic Intelligence (Elint)

12 Regional Analysis (Page No. - 66)

12.1 Introduction

12.2 North America

12.2.1 By Product Type

12.2.2 By Propulsion System

12.2.3 By Class

12.2.4 By Country

12.2.4.1 U.S.

12.2.4.1.1 By Product Type

12.2.4.1.2 By Propulsion System

12.2.4.1.3 By Class

12.2.4.2 Canada

12.2.4.2.1 By Product Type

12.2.4.2.2 By Propulsion System

12.2.4.2.3 By Class

12.3 Europe

12.3.1 By Product Type

12.3.2 By Propulsion System

12.3.3 By Class

12.3.4 By Country

12.3.4.1 Germany

12.3.4.1.1 By Product Type

12.3.4.1.2 By Propulsion System

12.3.4.1.3 By Class

12.3.4.2 Russia

12.3.4.2.1 By Product Type

12.3.4.2.2 By Propulsion System

12.3.4.2.3 By Class

12.3.4.3 U.K.

12.3.4.3.1 By Product Type

12.3.4.3.2 By Propulsion System

12.3.4.3.3 By Class

12.4 Asia-Pacific

12.4.1 By Product Type

12.4.2 By Propulsion System

12.4.3 By Class

12.4.4 By Country

12.4.4.1 India

12.4.4.1.1 By Product Type

12.4.4.1.2 By Propulsion System

12.4.4.1.3 By Class

12.4.4.2 China

12.4.4.2.1 By Product Type

12.4.4.2.2 By Propulsion System

12.4.4.2.3 By Class

12.4.4.3 Australia

12.4.4.3.1 By Product Type

12.4.4.3.2 By Propulsion System

12.4.4.3.3 By Class

12.5 Middle-East

12.5.1 By Product Type

12.5.2 By Propulsion System

12.5.3 By Class

12.5.4 By Country

12.5.4.1 U.A.E.

12.5.4.1.1 By Product Type

12.5.4.1.2 By Propulsion System

12.5.4.1.3 By Class

12.5.4.2 Israel

12.5.4.2.1 By Product Type

12.5.4.2.2 By Propulsion System

12.5.4.2.3 By Class

12.6 Rest of the World (RoW)

12.6.1 By Product Type

12.6.2 By Propulsion System

12.6.3 By Class

12.6.4 By Country

12.6.4.1 Brazil

12.6.4.1.1 By Product Type

12.6.4.1.2 By Propulsion System

12.6.4.1.3 By Class

12.6.4.2 South Africa

12.6.4.2.1 By Product Type

12.6.4.2.2 By Propulsion System

12.6.4.2.3 By Class

13 Competitive Landscape (Page No. - 124)

13.1 Introduction

13.2 Key Player Analysis of the Global Aerostat Systems Market

13.3 Competitive Situation and Trends

13.3.1 Contracts

13.3.2 New Product Launches

13.3.3 Partnerships, Agreements, Collaborations, and Joint Ventures

13.3.4 Others

14 Company Profiles (Page No. - 135)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Raytheon Company

14.3 Lockheed Martin Corporation

14.4 Tcom L.P.

14.5 Raven Industries Inc.

14.6 Exelis Inc.

14.7 Allsopp Helikites Ltd.

14.8 ILC Dover, L.P.

14.9 Israel Aerospace Industries (IAI)

14.10 Lindstrand Technologies Limited

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 153)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real Time Market Intelligence

15.4 Available Customizations

15.4.1 By Application

15.4.1.1 Defense

15.4.1.2 Civil

15.4.1.3 Commercial

15.4.2 Company Information

15.4.2.1 Detailed Analysis and Profiling of Additional Players (Up to 5).

15.5 Related Reports

List of Tables (67 Tables)

Table 1 Aerostat Systems Market Size, By Sub-System, 2014–2021 (USD Million)

Table 2 Functional Components for GCS

Table 3 Aerostat System Market Size, By Product Type, 2014–2021 (USD Million)

Table 4 Aerostat System Market Size, By Propulsion System, 2014–2021 (USD Million)

Table 5 Aerostat System Market Size, By Class, 2014–2021 (USD Million)

Table 6 Aerostat System Market, By Payload, 2014–2021 (USD Million)

Table 7 Aerostat System Market, By Region, 2014–2021 (USD Million)

Table 8 North America: Aerostat System Market, By Product Type, 2016-2021 (USD Million)

Table 9 North America: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 10 North America: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 11 North America: Aerostat System Market, By Country, 2014-21 (USD Million)

Table 12 U.S.: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 13 U.S.: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 14 U.S.: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 15 Canada: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 16 Canada: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 17 Canada: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 18 Europe: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 19 Europe: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 20 Europe: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 21 Europe: Aerostat System Market, By Country, 2014-2021 (USD Million)

Table 22 Germany: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 23 Germany: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 24 Germany: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 25 Russia: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 26 Russia: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 27 Russia: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 28 U.K .: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 29 U.K.: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 30 U.K.: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 31 APAC: Aerostat System Market, By Product Type, 2014-2021 (USD Million)

Table 32 APAC: Aerostat System Market, By Propulsion System, 2014-2021 (USD Million)

Table 33 APAC: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 34 APAC: Aerostat System Market, By Country, 2014-2021 (USD Million)

Table 35 India Market, By Product Type, 2014-2021 (USD Million)

Table 36 India: Market, By Propulsion System, 2014-2021 (USD Million)

Table 37 India: Market, By Class, 2014-2021 (USD Million)

Table 38 China Market, By Product Type, 2014-2021 (USD Million)

Table 39 China: Market, By Propulsion System, 2014-2021 (USD Million)

Table 40 China: Market, By Class, 2014-2021 (USD Million)

Table 41 Australia: Aerostat Systems Market, By Product Type, 2014-2021 (USD Million)

Table 42 Australia: Aerostat Systems Market, By Propulsion System, 2014-2021 (USD Million)

Table 43 Australia Aerostat Systems Market, By Class, 2014-2021 (USD Million)

Table 44 Middle-East: Aerostat Systems Market, By Product Type, 2014-2021 (USD Million)

Table 45 Middle-East: Aerostat Systems Market, By Propulsion System, 2014-2021 (USD Million)

Table 46 Middle-East: Aerostat System Market, By Class, 2014-2021 (USD Million)

Table 47 Middle-East: Aerostat System Market, By Country, 2014-2021 (USD Million)

Table 48 U.A.E.: Market, By Product Type, 2014-2021 (USD Million)

Table 49 U.A.E.: Market, By Propulsion System, 2014-2021 (USD Million)

Table 50 U.A.E.: Market, By Class, 2014-2021 (USD Million)

Table 51 Israel: Market, By Product Type, 2014-2021 (USD Million)

Table 52 Israel: Market, By Propulsion System, 2014-2021 (USD Million)

Table 53 Israel: Market, By Class, 2014-2021 (USD Million)

Table 54 RoW: Market, By Product Type, 2014-2021 (USD Million)

Table 55 RoW: Market, By Propulsion System, 2014-2021 (USD Million)

Table 56 RoW: Aerostat System , By Class, 2014-2021 (USD Million)

Table 57 RoW: Market, By Country, 2014-2021 (USD Million)

Table 58 Brazil: Market, By Product Type, 2014-2021 (USD Million)

Table 59 Brazil: Market, By Propulsion System, 2014-2021 (USD Million)

Table 60 Brazil: Market, By Class, 2014-2021 (USD Million)

Table 61 South Africa Market, By Product Type, 2014-2021 (USD Million)

Table 62 South Africa: Market, By Propulsion System, 2014-2021 (USD Million)

Table 63 South Africa: Market, By Class, 2014-2021 (USD Million)

Table 64 Contracts, 2010-2016

Table 65 New Product Launches, 2010-2016

Table 66 Partnerships, Collaborations, and Joint Ventures, 2010–2016

Table 67 Others, 2010–2016

List of Figures (112 Figures)

Figure 1 Markets Covered

Figure 2 Study Years

Figure 3 Limitations of the Research Study

Figure 4 Research Design

Figure 5 Projected Decline in the Production of Helium

Figure 6 Evolution of Sensor Technology

Figure 7 Bottom-Up Approach

Figure 8 Top-Down Approach

Figure 9 Market Breakdown and Data Triangulation

Figure 10 Geographic Analysis: Aerostat Systems Market, 2016

Figure 11 Demand for Large-Sized Aerostats That Can Carry A Heavier Payload is Fuelling the Growth of Market

Figure 12 Demand for Airships is Expected to Bolster the Growth of Market

Figure 13 Powered Aerostats Market is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 14 Rising Need for Enhanced Situational Awareness is Expected to Drive the Growth of the Communication Intelligence Segment

Figure 15 Contracts Comprised the Key Strategy Adopted By Market Players

Figure 16 Increasing Demand for Global Aerostat Systems

Figure 17 The Market for Aerostats is Expected to Witness Significant Growth

Figure 18 Airship Segment is Anticipated to Drive Market During 2016--2021

Figure 19 Unpowered Segment Will Drive the Market During 2016-2021

Figure 20 The Market for Large-Sized Aerostats is Expected to Register Significant CAGR During the Forecast Period

Figure 21 Surveillance Radar is Estimated to Account for A Major Share of the Market

Figure 22 North America is Expected to Account for the Highest Share of the Aerostat Market in 2021

Figure 23 Middle-East to Witness Remarkable Growth in the Coming Years

Figure 24 Aerostat Systems Market Segmentation: By Sub-System

Figure 25 Aerostat Systems Market Segmentation: By Product Type

Figure 26 Aerostat Systems Market Segmentation: By Propulsion System

Figure 27 Aerostat Systems Market Segmentation: By Class

Figure 28 Aerostat Systems Market Segmentation: By Payload

Figure 29 Market Dynamics for the Aerostat Systems Market

Figure 30 Porter’s Five Forces Analysis: Market

Figure 31 Global Market, By Sub-System, 2016-2021

Figure 32 Global Market, By Product Type, 2016-2021

Figure 33 Global Market, By Propulsion System, 2016-2021

Figure 34 Global Market, By Class, 2016-2021

Figure 35 Global Market, By Payload, 2016-2021

Figure 36 Surveillance Radar Payload in Aerostat Systems Market, 2016 vs 2021 (USD Million)

Figure 37 Inertial Navigation Systems Payload in Aerostat Systems Market, 2016 vs 2021 (USD Million)

Figure 38 Camera Payload in Market, 2016 vs 2021 (USD Million)

Figure 39 Communication Intelligence Payload in Market, 2016 vs 2021 (USD Million)

Figure 40 E0/IR Payload in Market, 2016 vs 2021 (USD Million)

Figure 41 Elint Payload in Aerostat System Market, 2016 vs 2021 (USD Million)

Figure 42 North America: Aerostat Systems Market, By Product Type, 2016-2021

Figure 43 North America: Market, By Propulsion System, 2016-2021

Figure 44 North America: Market, By Class, 2016-2021

Figure 45 North America: Market, By Country, 2016-2021

Figure 46 U.S.: Aerostat Systems Market, By Product Type, 2016-2021

Figure 47 U.S.: Aerostat Systems Market, By Propulsion System, 2016-2021

Figure 48 U.S.: Aerostat Systems Market, By Class, 2016-2021

Figure 49 Cananda: Aerostat System Market, By Product Type, 2016-2021

Figure 50 Canada: Aerostat System Markey, By Propulsion System, 2016-2021

Figure 51 Canada: Market, By Class, 2016-2021

Figure 52 Europe: Market, By Product Type, 2016-2021

Figure 53 Europe: Market, By Propulsion System, 2016-2021

Figure 54 Europe: Market, By Class, 2016-2021

Figure 55 Europe: Market, By Country, 2016-2021

Figure 56 Germany: Aerostat System Market, By Product Type, 2016-2021

Figure 57 Germany: Market, By Propulsion System, 2016-2021

Figure 58 Germany: Market, By Class, 2016-2021

Figure 59 Russia: Market, By Product Type, 2016-2021

Figure 60 Russia: Market, By Propulsion System, 2016-2021

Figure 61 Russia: Market, By Class, 2016-2021

Figure 62 U.K.: Market, By Product Type, 2016-2021

Figure 63 U.K Aerostat Systems Market, By Propulsion System, 2016-2021

Figure 64 U.K.: Aerostat Systems Market, By Class, 2016-2021

Figure 65 APAC: Market, By Product Type, 2016-2021

Figure 66 APAC: Market, By Propulsion System, 2016-2021

Figure 67 APAC: Market, By Class, 2016-2021

Figure 68 APAC: Aerostat System Market, By Country, 2016-2021

Figure 69 India: Aerostat Systems Market, By Product Type, 2016-2021

Figure 70 India Aerostat Systems, By Propulsion System, 2016-2021

Figure 71 India: Market, By Class, 2016-2021

Figure 72 China: Market, By Product Type, 2016-2021

Figure 73 China: Market, By Propulsion System, 2016-2021

Figure 74 China: Market, By Class, 2016-2021

Figure 75 Australia: Market, By Product Type, 2016-2021

Figure 76 Australia: Market, By Propulsion System, 2016-2021

Figure 77 Australia: Market, By Class, 2016-2021

Figure 78 Middle-East: Market, By Product Type, 2014-2021

Figure 79 Middle-East: Market, By Propulsion System, 2014-2021

Figure 80 Middle-East: Market, By Class, 2014-2021 (USD Million)

Figure 81 Middle-East: Market, 2016-2021

Figure 82 U.A.E.: Market, By Product Type, 2016-2021

Figure 83 U.A.E.: AerostaMarket, By Propulsion System, 2016-2021

Figure 84 U.A.E.: Market, By Class, 2016-2021

Figure 85 Israel: Market, By Product Type, 2016-2021

Figure 86 Israel: Market, By Propulsion System, 2016-2021

Figure 87 Israel: Market, By Class, 2016-2021

Figure 88 RoW: Market, By Product Type, 2016-2021

Figure 89 RoW: Market, By Propulsion System, 2016-2021

Figure 90 RoW: Market, By Class, 2016-2021

Figure 91 RoW: Market, By Country, 2016-2021

Figure 92 Brazil: Market, By Product Type, 2014-2021

Figure 93 Brazil: Market, By Propulsion System, 2014-2021

Figure 94 Brazil: Market, By Class, 2014-2021

Figure 95 South Africa: Market, By Product Type, 2014-2021

Figure 96 South Africa: Market, By Propulsion System, 2014-2021

Figure 97 South Africa: Market, By Class, 2014-2021

Figure 98 Companies Adopted New Product Launches & Expansions as Key Growth Strategies From 2010 to 2016

Figure 99 Lockheed Martin Corporation Holds the Leading Position in the Global Aerostat System Market in 2015

Figure 100 Global Aerostat System Market has Witnessed Significant Growth From 2013 to 2015

Figure 101 Contracts are One of the Key Growth Strategies

Figure 102 U.S. D.O.D Funding for Major Programs From 2007-2012

Figure 103 Geographic Revenue Mix of Key Market Players

Figure 104 Raytheon Company : Company Snapshot

Figure 105 Raytheon Company: SWOT Analysis

Figure 106 Lockheed Martin Corporation : Company Snapshot

Figure 107 Lockheed Martin Corporation : SWOT Analysis

Figure 108 Tcom L.P.: SWOT Analysis

Figure 109 Raven Industries Inc. : Company Snapshot

Figure 110 Raven Industries : SWOT Analysis

Figure 111 Exelis Inc.: Company Snapshot

Figure 112 Israel Aerospace Industries : Company Snapshot

The research methodology used to estimate and forecast the aerostat systems market begins with capturing data on key aerostat systems revenues through secondary research. The bottom-up procedure was employed to arrive at the overall market size of the aerostat systems market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, Directors and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

Scope of the Report

The ecosystem of the aerostat system market comprises defense departments, equipment suppliers, and regulatory authorities, among others. The aerostat system market is characterized by direct distribution channels and the presence of OEMs as well as Tier 1 & Tier 2 companies. Some of the key players of the aerostat system market include Lockheed Martin (U.S.), Raytheon Company (U.S.), TCOM L.P. (U.S.), and Raven Industries Inc. (U.S.), among others. These players are adopting strategies such as new product developments, long-term contracts, and expansions to strengthen their positions in the commercial avionics systems market. They are also focusing on developing new products by investing considerable amount of their revenues into research and development.

This report would help the aerostat systems equipment manufacturers, suppliers, and sub-component manufacturers to identify hot revenue pockets in this market.

“Furthermore, this study answers several questions for the stakeholders; primarily which segments to focus over the next five years for prioritizing efforts and investments”.

Target Audience

- Aerostat Systems Equipment Manufacturers

- Original Equipment Manufacturers

- Sub-component Manufacturers

- Technology Support Providers

Aerostat systems Market, By Product Type

- Balloon

- Airship

- Hybrid

Aerostat systems Market, By Propulsion System

- Powered

- Unpowered

Aerostat systems Market, By Class

- Compact-sized

- Mid-sized

- Large sized

Aerostat systems Market, By Payload

- Electro-optic/Infrared sensors (EO/IR)

- Communication intelligence

- Cameras

- Electronic intelligence

- Surveillance radar

- Inertial navigation system

Aerostat systems Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Aerostat Market, By Application

- Defense

- Commercial

- Civil

Available Customization

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs. The following customization options are available for the report:

Growth opportunities and latent adjacency in Aerostat Systems Market